Market Study for Injection Molding Machine in China

1. Introduction

1.1 Brief overview of the injection molding machine market in China

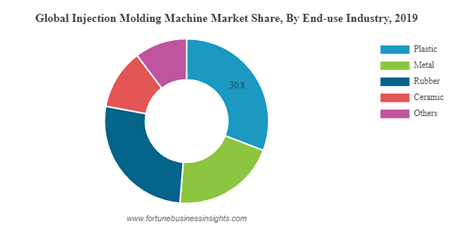

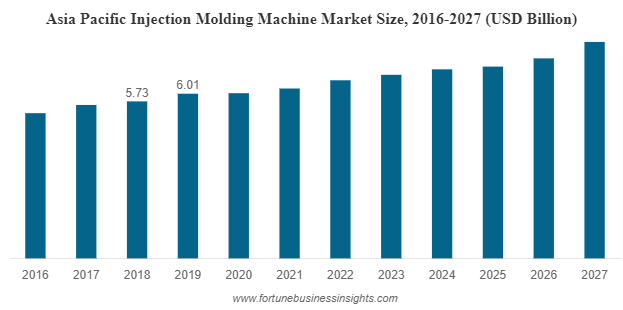

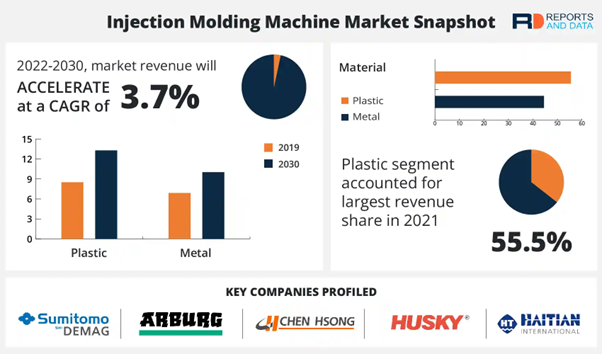

The injection molding machine market in China is a rapidly growing industry, driven by the demand for plastic products across various end-use sectors. Injection molding machines are widely used in the manufacturing of plastic products, ranging from automotive components to consumer goods, packaging, and electronics. The global injection molding machine market size was USD 15.39 billion in 2019 and is projected to reach USD 20.49 billion by 2027, exhibiting a CAGR of 4.1% during the forecast period. This growth can be attributed to the increasing demand for plastic products, coupled with the technological advancements and innovations in injection molding machines.

For businesses operating in China, it is crucial to understand the injection molding machine market to tap into the potential opportunities and remain competitive in the market. Injection molding machines are an integral part of the manufacturing process for various industries, and any fluctuations in the market can have significant implications on the supply chain and production costs.

1.2 Importance of understanding the market for businesses operating in China

Understanding the market trends and dynamics can also help businesses make informed decisions regarding investment, production, and procurement of injection molding machines. It can help businesses identify potential suppliers and partners, assess their capabilities, and negotiate better deals. Additionally, understanding the market can also aid businesses in developing effective marketing and sales strategies, enabling them to target the right audience and maximize their reach.

Furthermore, being aware of the market trends and customer preferences can also help businesses innovate and develop new products that cater to the evolving needs of end-users. For instance, the demand for lightweight and fuel-efficient vehicles is driving the growth of the injection molding machine market in the automotive sector. Similarly, the increasing focus on sustainability and eco-friendliness is spurring the demand for biodegradable and recycled plastic products, creating new opportunities for injection molding machine manufacturers and suppliers.

No doubt, the injection molding machine market in China is a dynamic and rapidly growing industry, driven by the demand for plastic products across various end-use sectors. Understanding the market trends, dynamics, and customer preferences is crucial for businesses operating in China to tap into the potential opportunities, remain competitive, and make informed decisions regarding investment, production, and procurement of injection molding machines. It can also help businesses develop effective marketing and sales strategies and innovate to cater to the evolving needs of end-users.

2. Insight

2.1 Market size and growth trends for injection molding machines in China:

The injection molding machine market in China is one of the largest in the world, accounting for a significant share of the global market. The global injection molding machine market is projected to reach USD 20.49 billion by 2027, exhibiting a CAGR of 4.1% during the forecast period. The growth in the market can be attributed to the increasing demand for plastic products across various end-use sectors, such as automotive, consumer goods, and electronics.

The automotive sector is one of the major end-users of injection molding machines in China, driven by the demand for lightweight and fuel-efficient vehicles. An annual growth of 14.18% is expected (CAGR 2023-2027) which will in return increase the projected market volume of US$323.60bn by 2027 creating new opportunities for injection molding machine manufacturers and suppliers. Electric Vehicles market unit sales are expected to reach 7.53m vehicles in 2027.

In addition to the automotive sector, the consumer goods sector is also a significant end-user of injection molding machines in China, driven by the increasing demand for household appliances, packaging, and personal care products. The electronics sector is also a major contributor to the growth of the injection molding machine market in China, driven by the increasing adoption of electronic devices and gadgets.

In terms of product types, the hydraulic injection molding machines dominate the market due to their low cost, high efficiency, and easy maintenance. However, the electric injection molding machines are gaining popularity due to their superior precision, energy efficiency, and environmental friendliness. The hybrid injection molding machines, which combine the advantages of hydraulic and electric machines, are also gaining traction in the market.

Overall, the injection molding machine market in China is expected to continue its growth trajectory in the coming years, driven by the increasing demand for high-quality plastic products and the adoption of advanced manufacturing technologies.

2.2 Key Players:

The injection molding machine market in China is highly competitive, with several domestic and international players operating in the market. Some of the key players in the market include Haitian International Holdings Limited, Chen Hsong Holdings Limited, Engel Austria GmbH, Arburg GmbH + Co KG, and Sumitomo (SHI) Demag Plastics Machinery GmbH.

Haitian International Holdings Limited is one of the leading players in the injection molding machine market in China. The company offers a wide range of injection molding machines, ranging from small to large machines, and serves various end-use sectors, such as automotive, packaging, and electronics.

Chen Hsong Holdings Limited is another major player in the injection molding machine market in China. The company offers a range of high-performance injection molding machines, including toggle machines, two-platen machines, and electric machines, and serves various end-use sectors, such as automotive, consumer goods, and packaging.

L.K. Technology is a leading manufacturer of injection molding machines and die-casting machines in China. The company offers a wide range of machines for various applications, including automotive, medical, and consumer goods. L.K. Technology has a strong focus on technology innovation and has been working to develop new machines that are more energy-efficient and environmentally friendly.

Cosmos Machinery Enterprises is a major player in the injection molding machine market in China. The company offers a wide range of machines for various applications, including automotive, packaging, and medical. Cosmos Machinery Enterprises has a strong focus on product quality and has been investing heavily in research and development to develop new technologies and improve its products.

Yizumi Group is another key player in the injection molding machine market in China. The company offers a wide range of machines for various applications, including automotive, consumer goods, and packaging. Yizumi Group has a strong focus on innovation and has been investing heavily in research and development to develop new products and technologies.

Overall, the injection molding machine market in China is highly competitive, with a large number of players competing for market share. The market is dominated by local players, but international players are also making inroads into the market. The key players in the market are focusing on innovation and product quality to gain a competitive edge and expand their market share.

2.3 Analysis of the demand and supply dynamics:

The injection molding machine market in China is characterized by a complex demand and supply dynamics, driven by various factors such as end-use sectors, technological advancements, and customer preferences. China is a major manufacturing hub for a wide range of industries, including automotive, consumer goods, and electronics, among others. Injection molding machines are widely used in the manufacturing process of these industries, making them an important part of the manufacturing ecosystem in China. The demand for injection molding machines is primarily driven by the increasing demand for plastic products across these industries.

In recent years, the demand for high-end and precision injection molding machines has been increasing in China. This is due to the increasing demand for high-quality products and the need for precision manufacturing in industries such as automotive and electronics. This has led to a shift towards more advanced injection molding machines, which offer higher precision and better control over the manufacturing process.

In terms of supply, the injection molding machine market in China is dominated by local manufacturers, who account for the majority of the market share. These manufacturers offer a wide range of injection molding machines, from small-tonnage machines to large-tonnage machines for various applications.

International manufacturers are also present in the market, but they tend to focus on the high-end segment of the market, offering machines with advanced technologies and features. These machines are generally more expensive than the machines offered by local manufacturers, but they are also known for their superior quality and precision.

Overall, the injection molding machine market in China is highly competitive, with several domestic and international players operating in the market. The market is characterized by intense competition among the players, driven by factors such as price, quality, and innovation. Additionally, technological advancements and innovations in injection molding machines are also driving the supply side dynamics, with players investing in R&D to develop new products and technologies.

Also, the dynamics are influenced by a range of factors, including the growth of the manufacturing sector, the need for high-end and precision machines, and the regulatory environment in the country. Manufacturers in the market are focused on developing advanced machines and technologies to meet the evolving needs of the manufacturing industry in China.

2.4 Regulatory environment and its impact on the market:

The regulatory environment in China plays a significant role in shaping the injection molding machine market in the country. The government has implemented several policies and regulations to promote the development and growth of the injection molding machine industry, such as tax incentives, subsidies, and favorable investment policies.

For instance, in 2019, the Chinese government launched the "Made in China 2025" initiative, aimed at promoting the development of high-end manufacturing industries, including the injection molding machine industry. The initiative provides various incentives and support measures, such as subsidies for R&D, investment in infrastructure, and favorable tax policies, to encourage the growth.

However, the government has also implemented regulations to limit the production and use of certain types of plastic products, which could have an impact on the demand for injection molding machines in the future.

3. News

3.1 Latest updates and developments in the injection molding machine industry in China

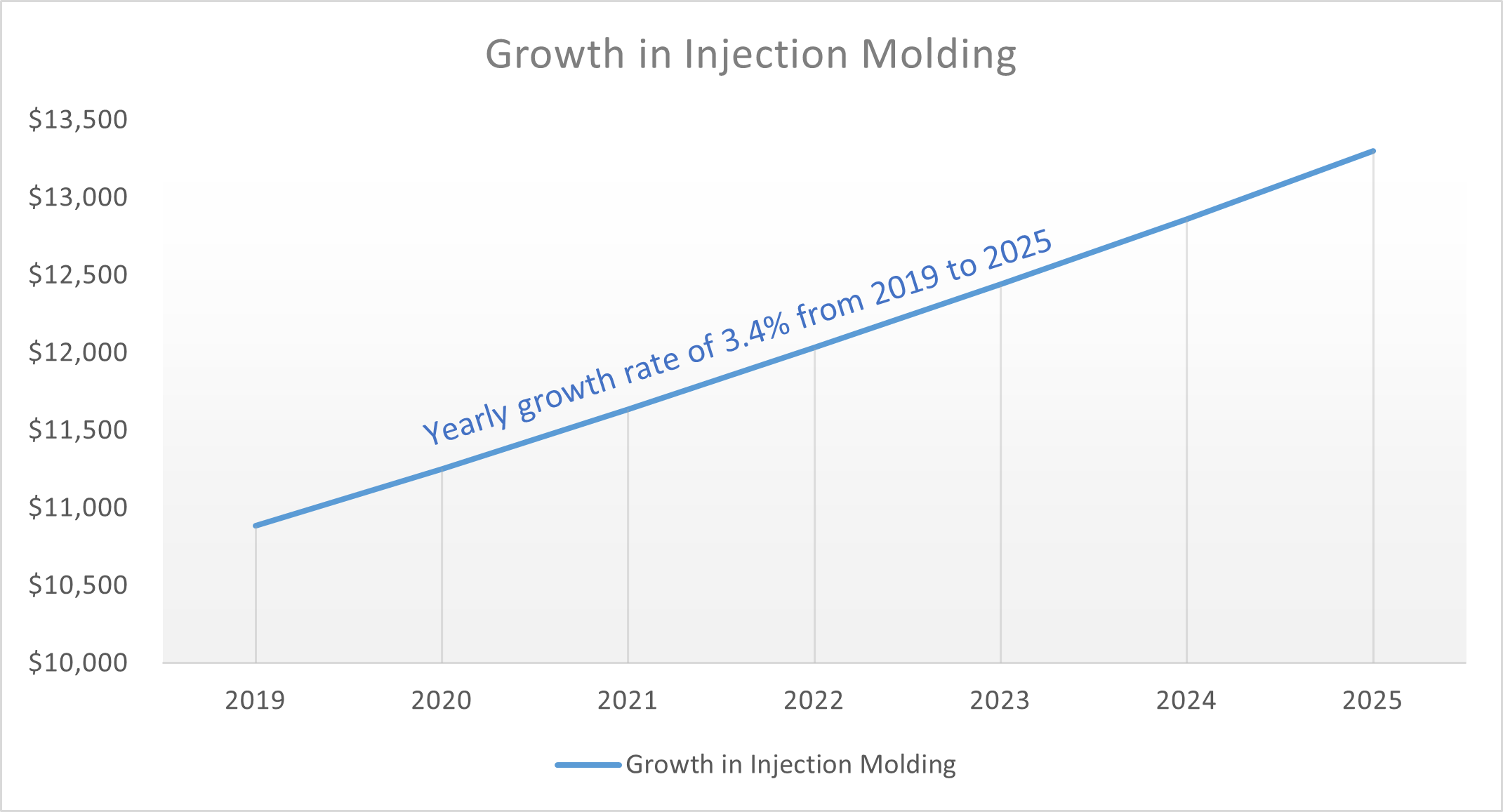

The injection moulding machine market has essentially reached saturation in recent years, and the industry has developed slowly. However, the global economy has progressively recovered from the recession since 2018. The injection moulding machine market is experiencing rapid growth due to the expansion of China's internal demand and the recovery of overseas demand. Because of the industry's continual improvement, the global injection moulding machine market value in 2019 was US$10884.04 million, with a compound yearly growth rate of 3.4% from 2019 to 2025.

China's injection moulding machine output accounts for more than 60% of global output, with most products going to Turkey, the United States, Southeast Asia, Brazil, and other countries. The main imported products are high-end all-electric variants, with prices many times those of exporting ones. The low-end market is dominated by Chinese firms, whereas the high-end market is dominated by European and Japanese firms. Haitian International, ENGEL Holding GmbH, KraussMaffei, ARBURG GmbH, Sumitomo Heavy Industries, Milacron, Wittmann Battenfeld, Fanuc, Shuangsheng, and others are among the major participants.

3.2 The Future Development Trend of Injection Molding Machine

As a piece of plastic product manufacturing equipment, the injection moulding machine is one of the industrial parent machines, and its downstream is quite dispersed, primarily including vehicles, home appliances, 3C, and so on. From 2003 to 2019, the output value of the injection moulding machine industry increased by 2-3 years and decreased by 1-2 years. Following a spike in 2017, the industry fell from 2018 to 2019 due to sluggish downstream of vehicles, household appliances, and 3C. The main developments expected in injection molding include the following:

A. Plastic evolution: The advancement of thermoplastic science and market demands have resulted in the production of hundreds of distinct types of thermoplastics with varying quality and properties. These characteristics include flexibility, resistance to high temperatures, transparent components, strength, durability, a larger range of colour possibilities, and improved electrical conductivity and friction.

B. Machine advancements: Technological advancements have had a significant impact on the efficiency of the injection moulding process. In particular, the use of Industry 4.0 concepts based on data and the Industrial Internet of Things (IIoT) has enabled producers to maximise equipment performance, resulting in increased efficiencies. The sort of machinery used by businesses can help them achieve higher sustainability and lower carbon emissions. Essentra Components is starting on an investment programme that will see the introduction of a full electric injection moulding machine portfolio by 2031.

C. Customer expectations: In addition to shifting market needs, developments in customer awareness and priorities are already influencing the world of injection moulding. Customers are concerned about their carbon footprint, and we have been able to dramatically increase the use of post-consumer recycled plastics in LDPE-manufactured components. Since April 2021, nearly all LDPE goods manufactured at the UK site have been made with at least 40% recycled polymers, with no reduction in quality or performance.

In the Chinese market, there are still numerous international brands of high-end injection moulding equipment. For example, KraussMaffei (KM), Engel, Milacron, Husky, and others all have manufacturing bases in China, yet their product prices are greater than those of Chinese companies. Because the domestic supply chain may be less affected by the new crown pneumonia outbreak than the international supply chain, Chinese brands such as Haitian International may penetrate the high-end market. At the same time, second-tier brands within the company are fighting to catch up to Haitian International.

3.3 Trends and innovations in the manufacturing sector

Technological improvements in the manufacturing industry are critical to the global economy's progress. Innovations that improve the productivity and sustainability of entire manufacturing processes are examples of emerging manufacturing trends. The following are the top ten Manufacturing Trends and Innovations for 2023:

1. Industrial Automation

2. Additive Manufacturing

3. Artificial Intelligence

4. Industrial Internet of Things

5. Immersive Technologies

6. Big Data & Analytics

7. Cloud Computing

8. 5G

9. Wearables

10. Green Manufacturing

These trends will significantly improve operational efficiency, decision making, and implement sustainability practices in a manufacturing company. Collaborative robots, autonomous mobile robots, smart factories, and other automated equipment increase productivity and reduce labor costs. Additive manufacturing opens the door to new design concepts that were unthinkable due to the limitations of traditional processes. IIoT devices and platforms ensure continuous monitoring of assets and increase shop floor visibility to the higher management. The IIoT data are inputs for AI algorithms that find hidden patterns and accelerate decision-making processes. In addition, the use of immersive technology and wearables increases worker efficiency and safety.

3.4 Impact of COVID-19 on the industry

To remain relevant, several businesses have shifted their tactics. Fortunately, plastic injection moulding is a diverse business with high output value. That didn't mean injection moulding companies and their partners couldn't evolve with the times. Among the noteworthy changes in the industry this year were:

A. Additives with antimicrobial and antiviral properties: Antimicrobials and antivirals are injection moulding additives that quickly gained favour during COVID-19 and that Midstate Mould has incorporated. These compounds have proven beneficial in giving long-term protection from microorganisms.

B. Shift in Reshoring: The epidemic has brought to light the disadvantages of offshore manufacturers, who have experienced substantial supply chain interruptions and shutdowns. As a result, companies have turned to reshoring to meet demand.

C. Pandemic Collaboration: To make up for losses, businesses partnered with injection moulding manufacturers to develop PPE and other medical equipment. Lego, for example, used its production lines to produce visors for healthcare personnel.

The plastic injection sector played a silent but significant role during COVID-19, providing much-needed PPE, medical devices, and ventilator parts to enterprises and frontline employees, and the increased reliance on US manufacturing accelerated the dissemination of these products.

3.5 The Negative Impact of COVID-19 on the Plastic Injection Industry

Despite its resilience, the plastic injection industry was not immune to COVID-19's economic impacts. While a worldwide epidemic would be expected to raise demand for medical utensils, there has been an astonishing shift to telemedicine services to handle other health issues and a drop in elective surgeries, reducing demand for plastic medical parts unrelated to COVID-19. Furthermore, with manufacturers needing a portion of their workforce to work from home, productivity has suffered, while a change to digital manufacturing and tool relocation has kept most supply chains running.

4. Blog

4.1 Challenges faced by customers and how they overcame them.

4.1.1 Language Barrier

This has been a widespread issue reported by numerous consumers. They are not fluent in many languages, and as a result, they misinterpreted the quotation. To win the business, they give a date that cannot be met and a reduced price that cannot be met, resulting in complete misunderstanding. Many consumers now prefer to have a middle agent that speaks and understands both languages in order to negotiate the price and obtain reliable information.

4.1.2 Change in Price

Small price variations do occur as a result of market material price fluctuations and labour expenses, but in other circumstances, small deviations might double or triple the initial price. Why? Because the pricing may not include the design element of the project or other steps in the overall process. Materials may also be sourced inconsistently, and the vendor may simply shop around for the lowest material cost for your estimate, which will not be accessible when you commission the injection moulding tools. Customers may now confirm that the vendor has included the cost of each step in the quotation, from research and design to test expenses.

4.1.3 Injection Molds Perform Poorly

Moulds may fail to perform satisfactorily. They may experience flashing at the separating lines, resin burning, short shots, sinks in the A-class surfaces, and other issues. Customers now prefer vendors who perform a mould flow analysis prior to providing the moulds. It will detect issue spots that may result in short shots and burns on the material.

4.2 Tips for dealing with Chinese suppliers and managing expectations

If you are a new importer trying to do business with Chinese manufacturers, you may initially find the procedure intimidating and even complicated. Here are five crucial pointers to assist you navigate the seas while dealing with Chinese vendors.

4.2.1 Manage FX Risk

To safeguard your profit margins from negative market movements, you must have a comprehensive risk management strategy in place.

There are three basic methods to get started:

o Speak with an expert who can assist you in developing a comprehensive risk management strategy based on your company's needs and objectives.

o Determine your RMB rate to maintain profit margins, consider entering into a forwards contract with a financial solution provider.

o Re-evaluate your risk management plan on a regular basis to keep up with market developments.

4.2.2 Develop Personal Ties Beyond Business

Treating your suppliers as friends and going above and above will strengthen your business ties and facilitate future negotiations. Here are a few examples:

Research their professional, academic, and personal backgrounds; consider long-term relationship building; identify key company decision-makers; and send them greetings for the Chinese New Year or invite them to your nation.

4.2.3 Understand Local Market Practice

While China has been a major source of variety, it is also a difficult market to navigate. Although China has taken numerous measures to expand its international trade, it is critical that you:

o Centralize communications with suppliers, use a local purchasing agent in China.

o Set up your own China office with local employees. Hire Mandarin-speaking personnel in your country to assist with supplier management.

4.2.4 Understand the Impact of Chinese Holidays

A Chinese New Year is a huge holiday that causes a massive closure, which might disrupt your supply chain and cost you more money due to late shipment. So, it's best to schedule your orders so that they don't suffer as a result of the New Year's festivities. It is not recommended to order in bulk immediately before the holidays because demand may increase, resulting in a price increase.

4.2.5 Choose the Right Type of Supplier

Not all Chinese businesses will be factories. There will be actual factories that make and assemble the products, but there will also be trading businesses that function as a broker or middleman between the customer and the actual manufacturers. It is critical to identify who you want to work with because you may wind up dealing with the trading one because they can grasp your requirements well, but they will offer a greater price than the true factory pricing. As a result, you must balance the advantages of dealing with both types before making your decision.